1 July to 31 January 2022. Taxpayers who cannot file electronically can do so at a SARS branch by appointment.

Sars Efiling How To Register Youtube

If you are using eFiling you can file from September 1 2020 until November 16 2020.

Sars efiling start date 2020. Taxpayers who cannot file online can do so at a SARS branch by appointment only. The South African Revenue Services SARS has announced that the 2020 Filing Season will begin on 1 August 2020. Taxpayers who file online.

In total SARS collected a gross amount of R1 6478 billion which was offset by refunds of R2919 billion. Im wondering if it doesnt have something to do with me registering with TaxTim. Taxpayers who cannot file online can do so at a SARS branch by appointment only.

I have a dedicated office with built in desks and shelves which was used exclusively by myself for my work. Provisional taxpayers who file online electronically - 1 July to 28 January. Provisional tax is not a separate tax from income tax.

From 1 August to 31 August 2020 Sars will auto-assess a significant number of individual non-provisional taxpayers. Thursday at 707 PM. Disaster Management Tax Relief for Employees Tax ETI and Provisional Tax 1 April 2020 SARS REVENUE ANNOUNCEMENT SARS has collected an amount of R1 3560 billion in the financial year ending 31 March 2020.

SARS drop-down would have it as Year 2021 for period Mar 2020 - Feb 2021. The closing date for non- provisional taxpayers will be 16 November 2020 and 31 January 2021 for provisional taxpayers. 1 July to 28 January 2022 This is the period for Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp.

The South African Revenue Service SARS has outlined changes to the coming tax filing season due to the impact of the coronavirus. The deadline to file a tax return will be 16 November 2020. I was home from 18 March 2020 to April 2021.

I thought Id give. Taxpayers who file online - 1 July to 23 November 2021. Starting July SARS said it will be assessing a.

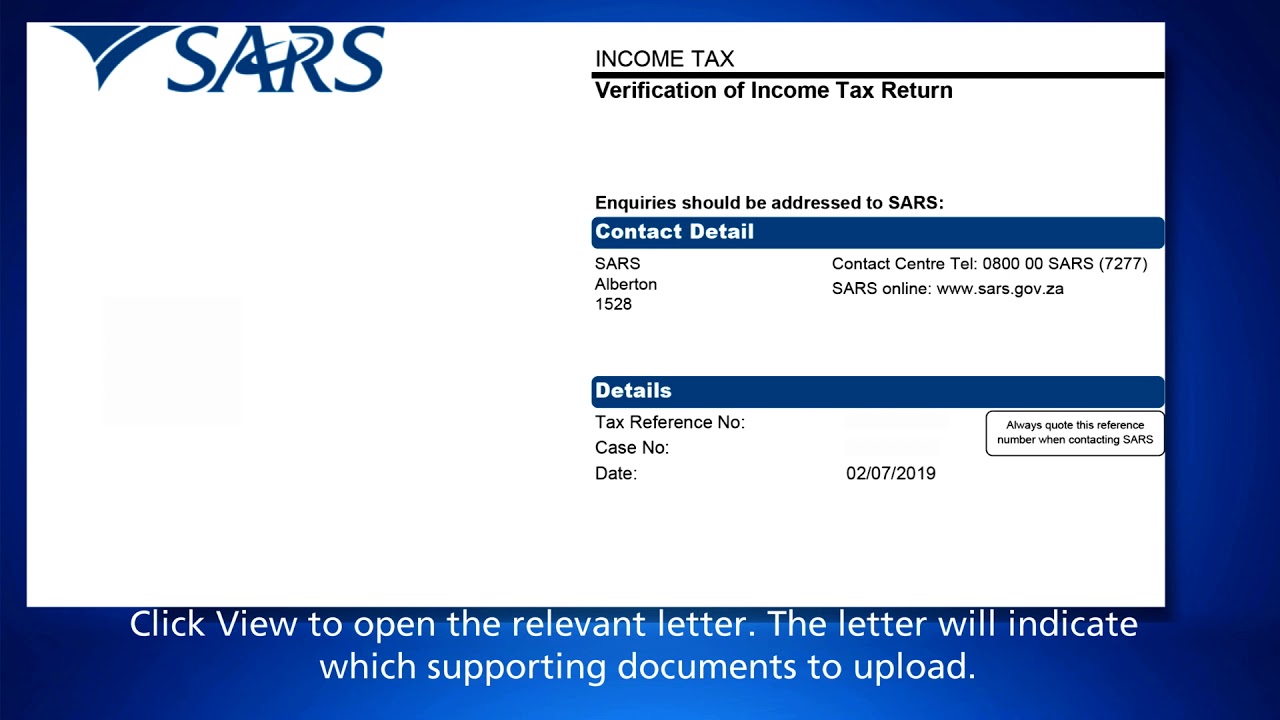

I terms of supporting docs what. Taxpayers who file online Taxpayers who cannot file online can do so at a SARS branch by appointment only. I think that is what he meant.

How to update your details on SARS eFiling is a video where I walk you through the process of updating your registered details with SARS on eFiling. In a presentation on Tuesday 5 May. We will update you as soon as we receive any further clarity from SARS.

Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. Taxpayers who cannot file online can do so at a SARS branch by appointment only. Keep in mind that queues at SARS are likely to be longer than usual so go early and go prepared.

It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax debt on assessment. Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. The assessment will be based on all third party data that Sars has for a.

1 July to 28 January 2022 This is the period for Provisional taxpayers including Trusts may file via eFiling or. 1 July to 23 November 2021. Taxpayers who file online.

1 July to 31. You might qualify to claim a tax deduction if you incurred expenses through working from home from the beginning of March 2020 to the end of February 2021 or if. 1 July to 23 November 2021.

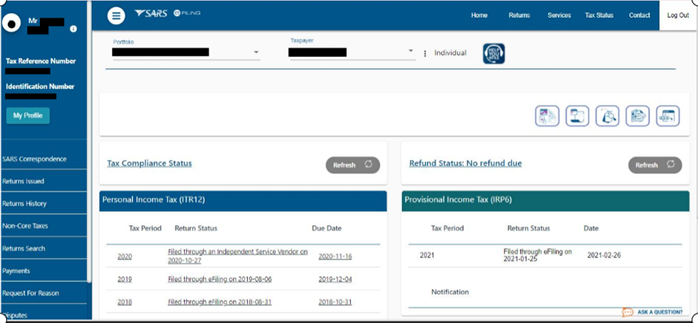

My efiling profile is empty no returns no returns history. Staff Writer 6 May 2020. Once you have received your IRP5 you may complete your tax return on our system it will be kept on our archive until tax season opens.

1 July to 31 January 2022. Taxpayers who cannot file online can do so at a SARS branch by appointment only. Individual income tax return filing dates.

At this stage it looks like the season will open on 1 September 2020 with some opportunity for early filing but these details need to be confirmed. The deadline for filing is October 22 2020. 9 June 2020 9 June 2020 Leave a Comment on What is Provisional Tax.

We will then be able to submit the tax return for you. Physical distancing will also slow things down.

Pin On Happening Now In South Africa

E Filing File Your Malaysia Income Tax Online Imoney Income Tax Returns E Filing In 2020 Online Taxes Income Tax Income

Tax Season South African Revenue Service

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling The Ultimate Guide Moneytoday

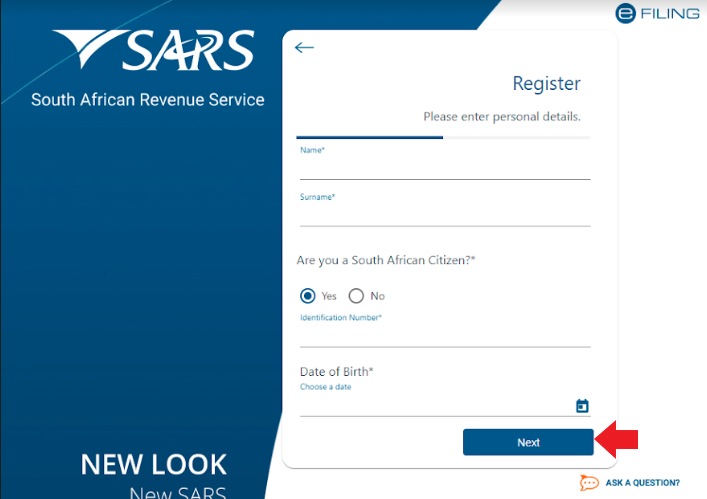

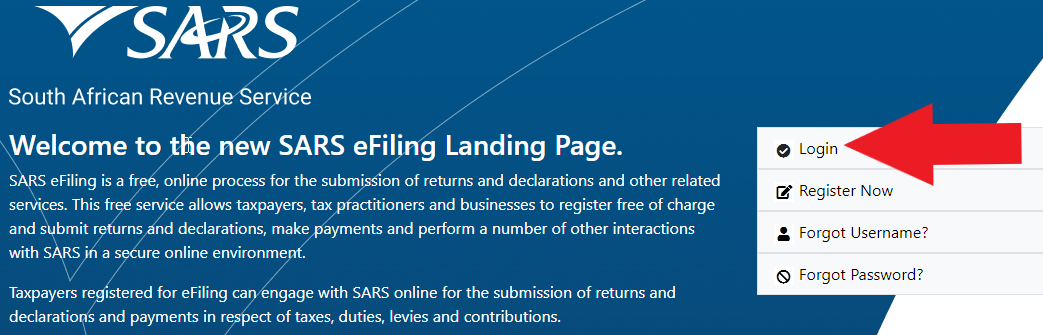

How To Register For Sars Efiling Taxtim Sa

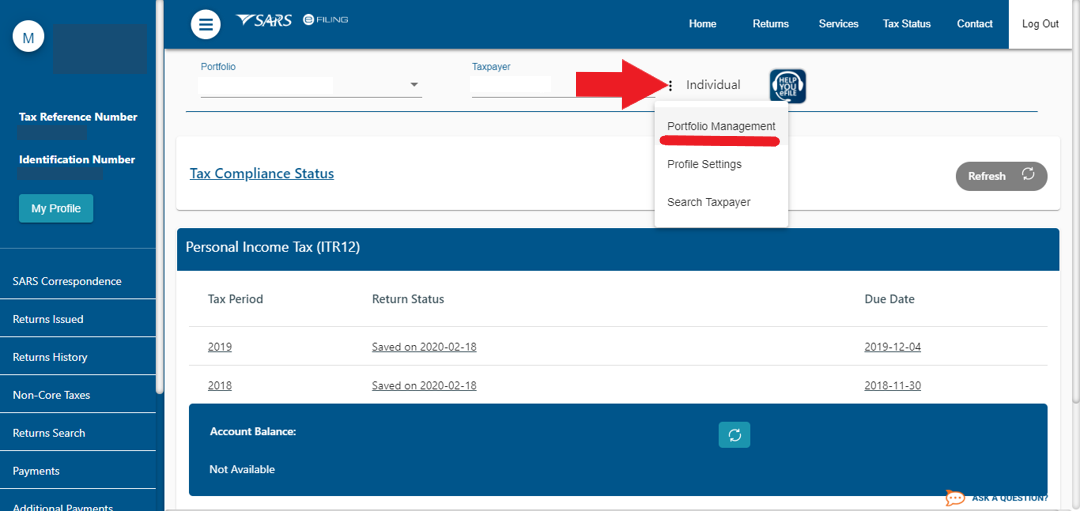

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Efiling How To Submit Documents Youtube

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Mobile Efiling For Pc Windows And Mac Free Download

How To Register Your Company For Sars Efiling Taxtim Sa

Tax Season 2020 Will Be Easier Thanks To Sars New Approach Ldp

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Tax Season South African Revenue Service

Thursday Deadline For Filing Income Tax Returns At Sars Branches

How To Submit Your 2020 Tax Return Sars Efiling Tutorial Youtube

It Starts With Auto Submission Sars Filing Your Return For You And Is Only A Provisional Assessment That You Assessment Indirect Tax Financial Statement